What is KYC?

As per the regulator SEBI, banks and financial institutions (FIs) have been advised to follow a certain customer identification procedure for opening of accounts and monitor transactions of suspicious nature for the purpose of reporting the same to an appropriate authority. These ‘Know Your Customer’ (KYC) guidelines have been published in the context of the recommendations made by the Financial Action Task Force (FATF) on Anti Money Laundering (AML) standards and on Combating Financing of Terrorism (CFT).

What are the available KYC procedures?

Offline

- Download the KYC application form from the CDSL Ventures website and fill it up.

- Sign and submit a physical copy to the specified authorities. The same can be submitted to the intermediaries through whom the investor wishes to invest in mutual funds.

- Attach the photocopies of ID proof, residence proof and a passport size photo.

Online (Aadhaar eKYC)

- This allowes a partial KYC with an investment of upto 50,000 per scheme per financial year.

- This had been available earlier through our APIs. However, it had been stopped in keeping with the regulatory ban on the use of Aadhaar to perform KYC. As per the latest news, it might be available once their is clarity from the regulator about the same.

Online (Video based)

- Digital solution to enable full KYC Know more

How does the API help you (the distributor)?

- 100% paperless

- Lower CAC (customer acqusition costs)

- Functionality to check the KYC status of the investor

- Instant investment without any waiting time (by taking investment orders alongwith KYC)

- Dev friendly APIs that can be integrated in under 3 days

- KYC and investments via the most trusted AMCs in India

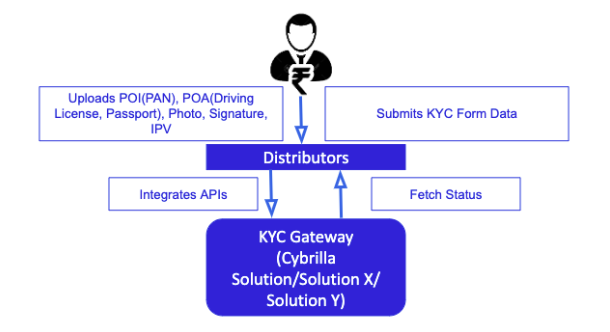

Workflow for Video KYC