Setting up eNACH/UPI-Autopay Mandate

An eNACH/UPI-Autopay mandate represents an investor's one-time authorization through netbanking/UPI, to debit payments from their bank account without the need for further manual payment authorisation. By setting up a mandate, investors can make both one-time purchases as well as recurring purchases such as FP Purchase Plans.

Setting up a eNACH or UPI-Autopay mandate for an investor involves two steps:

Step 1: Create an eNACH Mandate:

To create an eNACH or UPI-Autopay mandate, use the

Create eNACH/UPI-Autopay mandate

. This API requires specifying the mandate type (E_MANDATE for eNACH or UPI for UPI-Autopay), the investor's bank account ID for which the mandate is intended, and setting the maximum debit limit for the mandate.

{

"mandate_type": "E_MANDATE",

"bank_account_id": 123,

"mandate_limit": 100000

}

The maximum limit determines the highest amount that can be debited from the investor's bank account. This limit is typically set per transaction or per day, depending on the capabilities of the payment gateway:

| Payment Gateway | eNACH Maximum Limit | UPI-Autopay Maximum Limit | Remarks |

|---|---|---|---|

| Razorpay | Rs. 1 Cr | Rs. 1 Lakh | Limit is per transaction |

| BillDesk | Rs. 1 Cr | Rs. 1 Lakh | Limit is per day |

| BSE | Rs. 1 Cr | NA | Limit is per day |

Setting an appropriate maximum limit for the mandate is crucial as it directly impacts the number of FP Purchase plans that can be processed in a given day and the maximum amount that can be debited for each instalment.

UPI Autopay is an on-demand feature. To enable this functionality, kindly reach out to our support team.

Step 2: Authorize the Mandate:

Once the mandate is created with FP, you can proceed with authorizing the mandate to enable payment processing. To accomplish this, you need to use the Authorize eNACH/UPI-Autopay mandate , providing the Mandate ID received in the response from the Create eNACH/UPI-Autopay mandate step.

{

"mandate_id": 34

}

Upon initiating the

Authorize eNACH/UPI-Autopay mandate

, you will receive a token_url in the response. This token_url redirects the investor to their respective bank's netbanking page or UPI app to authorize the mandate. The approval of the mandate is typically immediate, with the authorization transaction successfully confirming the investor's consent. In rare cases, the approval process may take up to T+1 days for completion.

For UPI Autopay, a minimum amount of ₹1 is deducted from the investor's bank account during the authorization process. This amount is typically refunded within 3-5 bank working days. For Razorpay, the default authorization amount is ₹10. However, this amount can vary depending on the chosen pricing model and can be configured accordingly.

Note: BSE requires a gap of atleast one minute between Mandate creation and authorisation.

eNACH Mandate Cancellation:

Approved mandates can be cancelled if there is a requirement from the investor, such as a bank change or any other valid reason. To cancel an Approved mandate, you can utilize the

Cancel eNACH mandate

by passing the mandate ID as the request parameter.

For Razorpay and Billdesk, when a mandate is cancelled using the

Cancel eNACH mandate

, the mandate will be cancelled at payment provider's end as well. Even if the Razorpay mandate is deleted outside of FP, FP will mark the mandate as Cancelled to maintain accurate mandate status within the system. But for BSE mandates, please cancel the mandate in BSE dashboard before cancelling the mandate in FP.

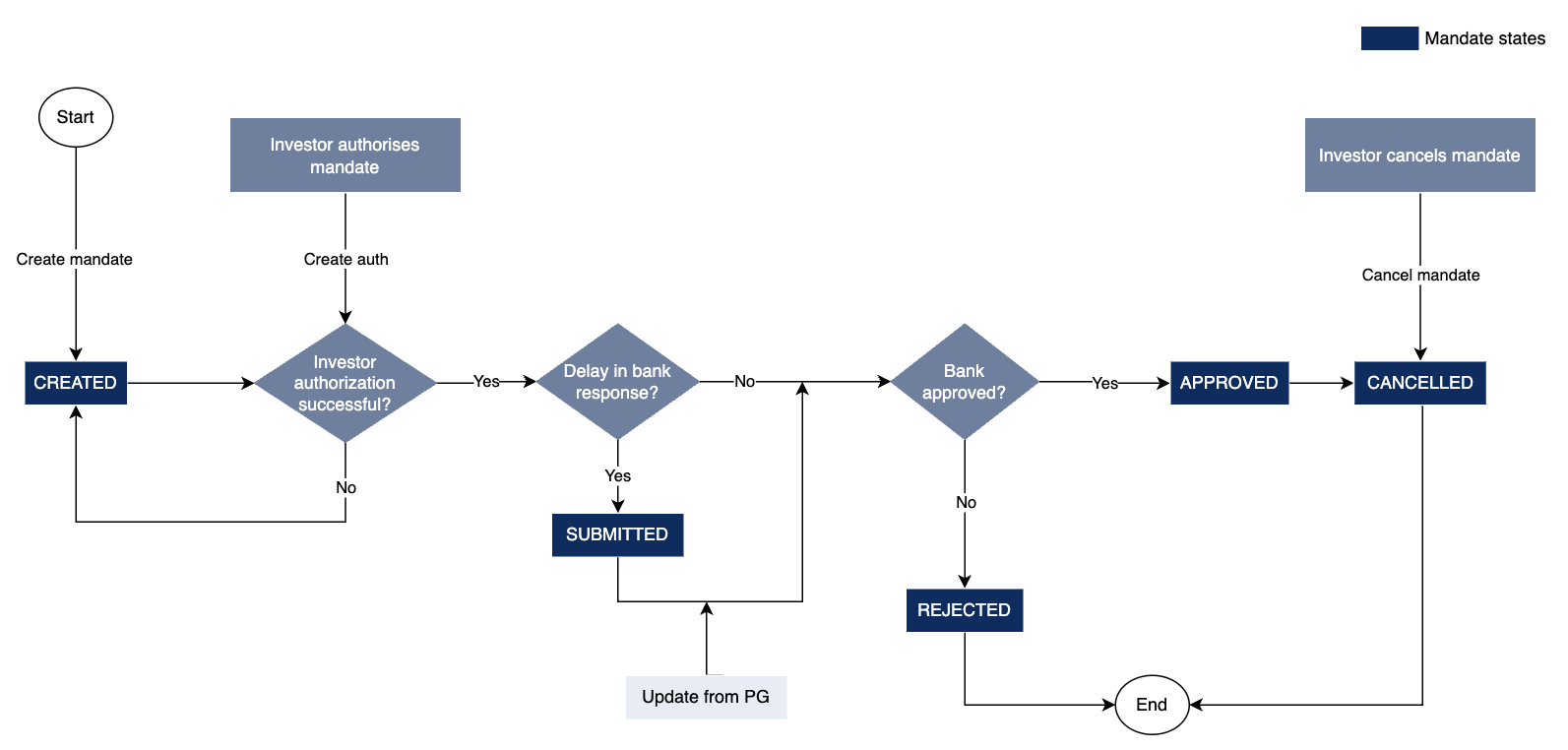

Mandate States

The mandate progresses through various statuses, each representing a specific stage in its life cycle. Understanding the behaviors associated with these statuses is essential for managing mandates effectively:

| Status | Behavior |

|---|---|

| CREATED | The mandate is created in both the FP system and the associated payment gateway(except BSE) but awaits authorization from the investor. |

| RECEIVED | Applicable only for BSE mandates. This means that mandate is created at BSE too, but yet to be authorized. |

| APPROVED | The mandate is approved and ready to be used for creating payments. |

| SUBMITTED | The authorization transaction is successful, indicating the investor's consent, but the mandate awaits final approval from the bank. |

| REJECTED | The authorization attempt was completed, but the bank rejected the mandate. Rejected mandates cannot be used for creating payments. |

| CANCELLED | The mandate has been cancelled. Cancelled mandates cannot be used for creating payments. |

Mandate Lifecycle

- One time payments using the eNACH mandate will be allowed only if mandate is in

approvedstate.- You can setup a recurring purchase plan with a mandate in

createdstate. On the installment generation day, if mandate is notapproved, the installment payment will be not be attempted by FP. The installment order will be marked as failed in such case. FP generates the installment on one day prior to the instalment date.